Gold prices witnessed a decline on Friday as investors chose to book profits after a significant rally over the past few weeks.

The precious metal, which had been on an upward trajectory due to global economic uncertainties, took a step back as market dynamics shifted.

In this article, we will analyze the key reasons behind the recent drop in gold prices, factors influencing the market, and crucial price levels to monitor in the upcoming week.

Gold Price Drop: Key Reasons Behind the Decline

Several factors contributed to the recent dip in gold prices. Here are some of the most significant ones:

1. Profit Booking by Investors

Gold has been on a sharp rally, touching multi-month highs. Investors who had gained substantial profits chose to sell their holdings before the weekend, leading to a decline in prices.

2. Strengthening US Dollar

The US dollar index strengthened against major currencies, making gold relatively expensive for buyers holding other currencies. A strong dollar typically exerts downward pressure on gold prices.

3. Rising US Bond Yields

Higher US Treasury yields reduce the appeal of non-yielding assets like gold. As bond yields rose, investors shifted their focus from gold to fixed-income securities, leading to a drop in gold demand.

4. Federal Reserve’s Policy Expectations

The Federal Reserve’s monetary policy stance significantly impacts gold prices. Recent statements from the Fed indicate that interest rates might remain elevated for longer, discouraging investments in gold.

5. Global Economic Developments

Recent economic data from major economies, including the US and China, suggested signs of resilience. A stable economic outlook reduces the urgency for investors to hedge against uncertainties using gold.

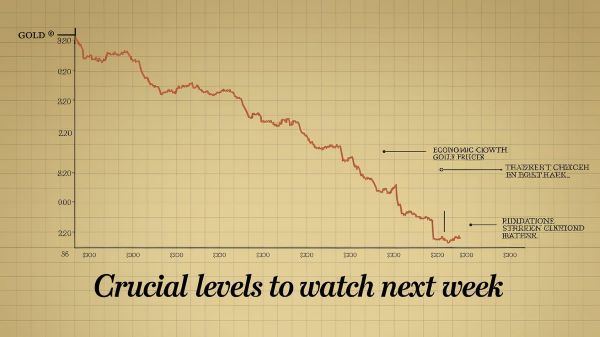

Crucial Support and Resistance Levels for Next Week

For traders and investors, monitoring key price levels is essential to understand market trends. Here are some important levels to watch next week:

1. Support Levels

- $2,150 per ounce – A crucial support level where buyers may step in.

- $2,100 per ounce – A stronger support level, below which gold might witness further decline.

2. Resistance Levels

- $2,200 per ounce – A near-term resistance level that could trigger fresh buying interest.

- $2,250 per ounce – A critical resistance level that gold needs to breach for an extended rally.

Market Outlook for Gold Prices Next Week

1. Impact of Economic Data Releases

Next week, key economic reports such as US GDP growth, inflation data, and employment figures will play a crucial role in determining gold’s direction. If inflation remains high, gold may regain strength as a hedge against inflation.

2. US Federal Reserve Meeting Signals

Any hints from the Fed regarding future interest rate hikes or cuts will directly impact gold prices. A dovish stance could support gold, while a hawkish approach may push prices lower.

3. Geopolitical Developments

Tensions in the Middle East, trade disputes, or any unexpected geopolitical events could increase safe-haven demand for gold, reversing the current downward trend.

4. Demand from Central Banks and Retail Buyers

Central banks worldwide have been accumulating gold reserves. Any increase in purchases by central banks could support gold prices. Additionally, demand from retail buyers, especially in countries like India and China, will be a key factor to monitor.

Investment Strategies for Gold Traders

Given the current market volatility, traders and investors should adopt a balanced approach to gold trading.

1. Short-Term Trading Approach

- Traders can look for buying opportunities near support levels and sell near resistance levels.

- Keeping an eye on US dollar movements and bond yields will be crucial for short-term trades.

2. Long-Term Investment Perspective

- Investors with a long-term horizon should use price dips as buying opportunities.

- Diversifying portfolios with gold as a hedge against inflation and economic uncertainties remains a wise strategy.

Conclusion

Gold prices declined as investors booked profits following a significant rally. The strengthening US dollar, rising bond yields, and expectations of prolonged high interest rates contributed to the drop.

Going forward, key price levels, Federal Reserve signals, economic data, and geopolitical events will play a crucial role in determining gold’s movement.

Investors should remain vigilant and adopt appropriate strategies to navigate the fluctuating gold market.