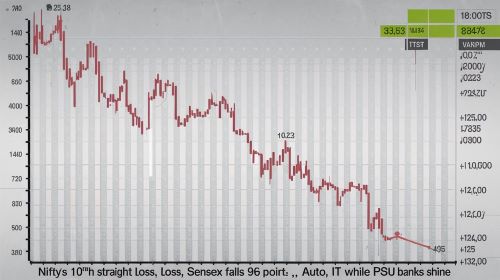

Indian stock markets extended their losing streak on March 4, marking the 10th consecutive session of decline. The BSE Sensex closed 96.01 points lower at 72,989.93, while the NSE Nifty fell 36.65 points to end at 22,082.65.

Despite the weak closing, the broader market showed resilience, with select PSU banks, media, and small-cap stocks witnessing strong buying interest.

Key Highlights of the Market Closing on March 4, 2024

- Sensex Falls for 10th Straight Day: The index slipped 96.01 points (0.13%), closing at 72,989.93.

- Nifty Below 22,100: The benchmark index fell 36.65 points (0.17%), settling at 22,082.65.

- Sectoral Performance:

- Auto & IT Stocks Drag: Selling pressure was seen in automobile and IT sectors.

- PSU Banks & Media Stocks Shine: Buying interest was high in PSU banks and media stocks.

- Global Market Cues: Weak global sentiment and concerns over global trade tensions impacted investor confidence.

Market Sentiment and Expert Insights

1. Global Market Cues Weigh on Indian Indices

The Indian stock market suffered from weak global cues, primarily due to:

- Escalating trade tensions between major economies.

- Concerns over rising inflation and its impact on interest rate policies.

- Mixed signals from US and European markets affecting investor confidence.

2. Broader Markets Outperform

Despite the weakness in frontline indices, the broader market remained resilient. Investors were seen taking interest in small-cap and mid-cap stocks, indicating value-buying opportunities in select sectors.

According to Vinod Nair, Head of Research, Geojit Financial Services,

“The domestic market exhibited a recovery from today’s lows but remained in negative territory due to adverse global cues related to escalating trade tensions. However, small-cap stocks gained on value buying.”

3. Sector-Wise Performance

A. Auto and IT Stocks Under Pressure

The auto and IT sectors dragged the market lower as concerns over global economic slowdown weighed on investor sentiment. Stocks like Tata Motors, Maruti Suzuki, Infosys, and TCS witnessed selling pressure.

B. PSU Banks and Media Stocks Outperform

- PSU bank stocks saw strong buying interest, with stocks like SBI, PNB, and Bank of Baroda gaining traction.

- Media stocks also saw an uptrend as investors focused on value-buying opportunities in this segment.

4. Technical Outlook: What’s Next for Nifty and Sensex?

The Nifty continues to remain under pressure but has key support levels at 22,000 and 21,850. Analysts believe:

- A break below 21,850 could lead to further downside.

- A recovery above 22,200 might trigger fresh buying interest.

Investor Strategy Amid Market Volatility

1. Focus on Defensive Sectors

Given the current volatility, investors should consider defensive stocks from sectors like FMCG, Pharma, and PSU Banks for stability.

2. Look for Value-Buying Opportunities

- Small-cap and mid-cap stocks showing strong fundamentals may offer long-term investment potential.

- Stocks in the banking and media sector continue to be attractive for short-term gains.

3. Monitor Global Market Trends

Investors must track global market developments, particularly:

- US Fed’s stance on interest rates.

- Trade tensions and economic data from China and the US.

Conclusion: Will Nifty and Sensex Recover?

Despite the 10-day losing streak, the Indian market still holds potential for a rebound. A reversal in global trends and improved domestic economic indicators could drive a recovery in the coming sessions.