Retirement Planning Gains Prominence Amid Rising Inflation and Economic Uncertainty

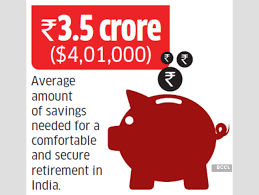

New Delhi: A recent HSBC report has unveiled a significant shift in financial aspirations among affluent Indians. According to the HSBC Affluent Investor Snapshot 2025, wealthy Indian investors now believe they need ₹3.5 crore (approximately $401,000) to retire comfortably. This is a notable rise from previous years and reflects a growing concern about inflation, lifestyle costs, and long-term financial independence.

The survey, conducted among 1,006 affluent Indian investors, is part of a global study covering over 10,797 respondents across 12 countries. It indicates that “retirement planning” has now become one of the top financial priorities for Indians, alongside property investment and supporting family members.

Key Highlights of the HSBC Survey 2025

- Average retirement target: ₹3.5 crore for a comfortable post-retirement life

- Top priorities: Retirement planning, real estate, family support

- Main concerns: High inflation, economic uncertainty

- Confidence in financial planning: 92% in short-term, 83% in medium-term, and 86% in long-term

- Investment trends: Decline in cash holdings, increased interest in mutual funds, gold, and private markets

Rising Cost of Living Drives Retirement Goals Higher

The upward revision of the ideal retirement corpus from previous years highlights the increasing cost of living in urban India, especially among affluent families. Many investors cited that lifestyle expectations, healthcare needs, and inflation are primary reasons behind this new benchmark of ₹3.5 crore.

Keyword-rich note: Retirement planning for Indians, cost of retirement in India, inflation impact on retirement, how much do you need to retire in India.

Retirement Planning Now a Top Priority

Indians Are Shifting Focus from Short-Term Gains to Long-Term Security

The HSBC survey found that a majority of Indian investors now place retirement planning above other financial goals. It ranks higher than buying real estate or funding children’s education.

Top Long-Term Priorities Among Affluent Indians:

- Building a secure retirement fund

- Investing in property for wealth creation

- Financially supporting elderly parents and dependent children

- Building an inheritance

Indians Display High Financial Confidence

Despite macroeconomic challenges, Indian investors show a high level of confidence in managing their wealth:

- 92% are confident about achieving their short-term financial goals (within 3 years)

- 83% express confidence in meeting medium-term goals (3 to 5 years)

- 86% believe they will achieve long-term financial goals (beyond 5 years)

This optimism reflects robust financial planning, growing financial literacy, and diversified investment portfolios among affluent Indians.

Changing Investment Patterns: From Cash to Alternatives

Indian Investors Are Now More Proactive in Asset Allocation

One of the most notable shifts observed in the 2025 report is the sharp decline in cash holdings. The portion of wealth held in cash has dropped from 25% last year to just 15% now. Instead, investors are choosing assets that can better withstand inflation and deliver long-term returns.

Most Popular Investment Choices in 2025:

- Mutual Funds: Owned by 53% of respondents

- Direct Stocks: 50% ownership

- Physical Gold: Held by 39% of investors

- Private Market Funds: Interest from 42%

- Multi-Asset Solutions: Considered by 37%

Keyword stuffing: best investment for retirement in India, mutual fund investment trends 2025, gold investment in India, private market funds India, inflation-proof assets for Indians.

Reliance on Financial Advice and Digital Channels

Social Media Plays a Role, But Experts Still Rule

Modern Indian investors are increasingly relying on digital platforms for financial insights. However, when it comes to actual decision-making, professional advice still dominates.

Sources of Financial Advice:

- Professional advisers / wealth managers: 66%

- Social media influencers: 41%

- Online videos and digital content: 50%

This blend of digital convenience and expert guidance is reshaping how affluent Indians approach their wealth.

What This Means for India’s Financial Future

With retirement planning emerging as a core priority, it is clear that Indian investors are preparing for a more secure, self-reliant future. The goal of accumulating ₹3.5 crore signals a serious and structured approach to wealth creation and risk mitigation.

Expert Tips for Achieving ₹3.5 Crore Retirement Goal

- Start early: Begin saving and investing in your 20s or 30s

- Diversify: Invest across equity, debt, gold, and real estate

- Inflation-proof your portfolio: Focus on real returns, not nominal

- Seek expert advice: Work with financial planners for personalized strategies

- Review annually: Adjust plans according to income, inflation, and market dynamics

Final Thoughts

India’s affluent investors are evolving rapidly. With rising aspirations, longer life spans, and inflationary pressures, retirement planning in India is no longer optional — it’s essential. The benchmark of ₹3.5 crore as a retirement corpus may continue to rise, pushing individuals to take financial independence more seriously.

SEO-rich closing note: If you’re wondering how much money you need to retire in India, start with a goal of ₹3.5 crore. Begin investing early, use mutual funds, gold, and private markets smartly, and seek professional guidance to secure your financial future.